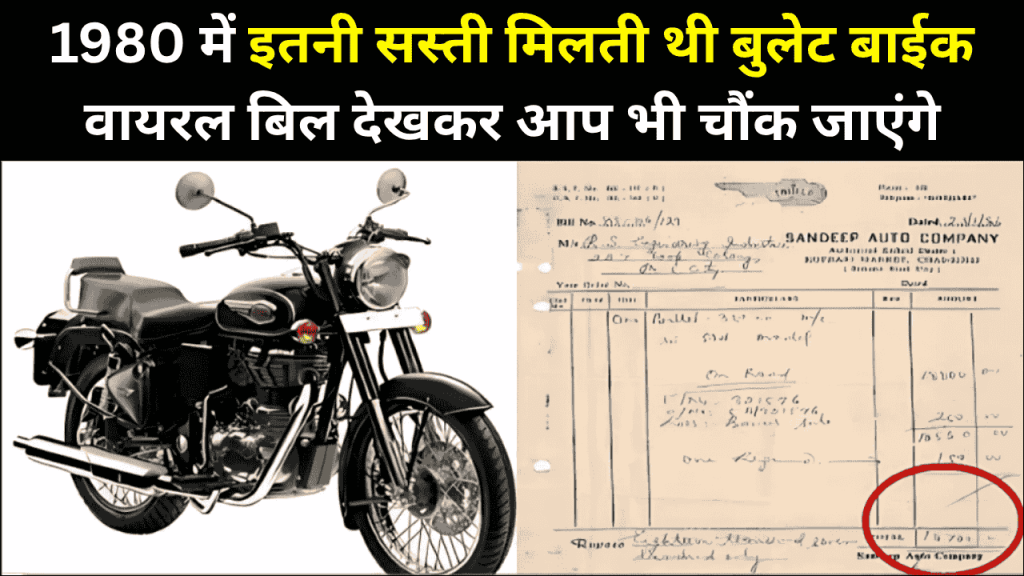

The Royal Enfield Bullet 350, an iconic motorcycle with a rich heritage dating back to 1932, has witnessed a dramatic price evolution over the decades. From a modest ₹18,700 in 1986 to exceeding ₹1.75 lakhs in 2025, this price surge represents an increase of over 835%. This article explores the multiple factors behind this significant price appreciation and examines what makes the Bullet 350 continue to command both respect and premium pricing in today’s motorcycle market.

The Price Evolution Journey

The Royal Enfield Bullet’s price trajectory tells a story of both India’s economic transformation and the evolution of motorcycle manufacturing. Let’s trace this remarkable journey through the decades:

| Year | Approximate Price (₹) | Major Economic/Industry Event |

|---|---|---|

| 1986 | 18,700 | Pre-liberalization era, limited competition |

| 1995 | 42,000 | Economic liberalization effects begin |

| 2005 | 70,000 | Stricter emission norms introduced |

| 2010 | 98,000 | BS-III implementation |

| 2015 | 1,20,000 | Premium positioning strategy begins |

| 2020 | 1,50,000 | BS-VI implementation |

| 2025 | 1,75,000+ | Advanced technology integration, brand premium |

This 835% price increase over nearly four decades reflects more than just inflation—it represents a complex interplay of regulatory changes, technological advancements, and strategic brand positioning.

Key Factors Behind the Price Increase

1. Inflation and Economic Factors

India’s cumulative inflation has been a significant contributor to the price rise. The purchasing power of the rupee has declined substantially over these decades, affecting all consumer goods including motorcycles.

| Period | Avg. Annual Inflation | Cumulative Effect |

|---|---|---|

| 1986-1995 | 8.8% | ~117% price increase |

| 1996-2005 | 5.4% | ~68% price increase |

| 2006-2015 | 7.2% | ~99% price increase |

| 2016-2025 | 4.8% | ~59% price increase |

While inflation alone would have pushed the 1986 price of ₹18,700 to approximately ₹1,25,000 by 2025, the actual price exceeds this figure, indicating other significant factors at play.

2. Regulatory Compliance and Emission Standards

The implementation of increasingly stringent emission norms has dramatically impacted motorcycle manufacturing costs:

- BS-I to BS-II (2000-2005): Required fuel injection system upgrades

- BS-III (2010): Mandated catalytic converters and oxygen sensors

- BS-IV (2017): Required improved fuel injection systems and engine modifications

- BS-VI (2020): Necessitated complete powertrain overhaul, including:

- Advanced fuel injection systems

- Additional catalytic converters

- Oxygen sensors

- Engine control units (ECUs)

These regulatory changes alone added approximately ₹15,000-₹25,000 to the manufacturing cost per motorcycle during the BS-IV to BS-VI transition.

3. Technological Advancements and Quality Improvements

The modern Royal Enfield Bullet 350 is technologically far superior to its 1986 counterpart:

| Feature | 1986 Model | 2025 Model |

|---|---|---|

| Engine | Cast iron, carbureted | Aluminum, fuel-injected |

| Braking | Drum brakes | Disc brakes with ABS |

| Electrical | 6V system, basic | 12V system with LED lights |

| Ignition | Points/magneto | Electronic ignition |

| Frame | Basic steel | Advanced alloy construction |

| Features | Basic instrumentation | Digital-analog cluster, USB charging |

Each technological upgrade has added to both the manufacturing cost and the value proposition of the motorcycle.

4. Brand Positioning and Market Strategy

Since Eicher Motors’ takeover in 1994 and Siddhartha Lal’s leadership beginning in 2000, Royal Enfield has strategically repositioned itself:

- 1986-2000: Positioned as a utilitarian, government-approved motorcycle

- 2000-2010: Transition period focusing on reliability improvements

- 2010-Present: Premium lifestyle brand with heritage appeal

This deliberate shift from utility vehicle to lifestyle product has allowed Royal Enfield to command higher price points while developing a devoted customer base willing to pay for the brand’s heritage and unique riding experience.

5. Manufacturing Approach and Supply Chain Factors

Royal Enfield’s manufacturing philosophy has evolved significantly:

- 1986: Largely hand-built with basic tooling and high labor input

- 2025: Modern manufacturing methods with precision tooling, but retaining craft elements

While modern manufacturing is more efficient, the retention of certain hand-crafted elements and quality control measures adds to the cost structure. Additionally, the global supply chain disruptions post-2020 have increased component costs by 15-20% for specialized parts.

6. Distribution Network and Dealer Experience

The evolution of Royal Enfield’s retail approach has added costs but also enhanced customer experience:

- 1986: Basic dealerships with minimal amenities

- 2025: Premium experience centers with dedicated service areas, merchandise, and customer engagement activities

This enhanced retail experience adds approximately 8-10% to the final motorcycle cost but is considered essential to the brand’s premium positioning.

Comparative Analysis: Price vs. Value Proposition

When adjusted for inflation alone, the ₹18,700 from 1986 would equate to approximately ₹1,25,000 in 2025 currency. The actual price exceeding ₹1,75,000 represents an additional premium of about ₹50,000, which can be attributed to:

- Enhanced features and technology: ~₹25,000

- Brand premium: ~₹15,000

- Improved customer experience: ~₹10,000

Interestingly, when comparing the percentage of average annual income required to purchase a Bullet 350:

| Year | Bullet 350 Price | Avg. Annual Income (Urban India) | % of Annual Income |

|---|---|---|---|

| 1986 | ₹18,700 | ₹24,000 | 77.9% |

| 2025 | ₹1,75,000 | ₹3,20,000 | 54.7% |

This suggests that despite the absolute price increase, the Bullet 350 has actually become relatively more affordable when measured against average income.

The Cultural Factor: From Transport to Lifestyle

Perhaps the most intangible but powerful factor in the price evolution is the Bullet’s cultural transformation. What began as primarily a means of transportation has evolved into a cultural icon representing a distinct lifestyle choice and community membership.

This shift from utility to identity marker has enabled Royal Enfield to move upmarket without losing its core appeal. The “Bullet premium” now includes access to organized rides, events, and a global community of enthusiasts—value propositions entirely absent from the 1986 pricing model.

Future Outlook: What’s Next for Bullet Pricing?

As we look toward the future, several factors are likely to influence the Bullet 350’s pricing trajectory:

- Electrification pressure: Development costs for electric alternatives will likely be passed partially to consumers of traditional models

- Advanced safety features: Upcoming safety regulations may add ₹8,000-₹12,000 to manufacturing costs

- Scarcity premium: As internal combustion engines face increasing regulation, traditional models may command higher prices

- Heritage value: The longer the Bullet remains in production, the stronger its heritage appeal becomes

Industry analysts project the Bullet 350 could reach the ₹2.25 lakh mark by 2030, representing another 28% increase over current prices.

Conclusion: More Than Inflation

The transformation of the Royal Enfield Bullet 350 from an ₹18,700 utilitarian motorcycle to a ₹1.75 lakh lifestyle statement represents far more than simple inflation. It reflects India’s economic evolution, changing regulatory landscapes, technological advancement, and the remarkable brand journey of Royal Enfield itself.

While the price increase may seem steep in absolute terms, the enhanced value proposition, relative affordability compared to incomes, and the intangible benefits of Bullet ownership suggest that for its devoted following, the modern Bullet 350 continues to represent good value—just in a very different way than its 1986 ancestor.

Frequently Asked Questions

Why does the Royal Enfield Bullet 350 command a premium price compared to other 350cc motorcycles?

The Bullet 350’s premium pricing stems from several factors: its unmatched heritage dating back to 1932, making it the oldest motorcycle in continuous production; its distinctive thumping engine character that cannot be replicated by modern designs; and the robust community and lifestyle association that comes with ownership. The hand-crafted elements in manufacturing and the brand’s deliberate positioning in the premium segment also contribute significantly to its price point.

Has the actual value of the Bullet 350 increased in line with its price?

When accounting for technological advancements, safety features, emissions compliance, and manufacturing quality, the value proposition of today’s Bullet 350 far exceeds its 1986 counterpart. Features like fuel injection, ABS braking, improved metallurgy, and enhanced electrical systems represent genuine value additions. Additionally, when adjusted for average income growth, the Bullet 350 actually requires a smaller percentage of annual income today than in 1986, suggesting improved relative affordability despite the higher absolute price.

Will Royal Enfield motorcycles continue to increase in price at the same rate in coming years?

While price increases will likely continue, the rate may moderate somewhat. The major costs associated with BS-VI compliance have already been absorbed, though upcoming safety regulations and potential electrification development costs may drive further increases. Royal Enfield must also balance premium pricing with market accessibility to maintain its growth trajectory. Industry analysts project more moderate annual increases of 4-6% over the next five years, barring major regulatory changes.

Is the vintage appeal of Royal Enfield motorcycles worth the modern price tag?

This ultimately depends on individual priorities. For riders seeking cutting-edge performance and technology at the lowest possible price point, other options may provide better value. However, for those who value the unique riding experience, heritage, community aspects, and distinctive character that come with Royal Enfield ownership, the premium is often considered justified. The brand’s continued sales growth despite price increases suggests that a significant segment of the market finds the value proposition compelling.